A crucial component of risk management for companies that depend on loans to finance their operations is business loan insurance. Business owners may protect their investments and make well-informed decisions by being aware of the cost of business loan insurance. This post will give a thorough explanation of the variables that affect business loan insurance prices, along with the advantages it presents and practical cost-controlling techniques.

What is Business Loan Insurance?

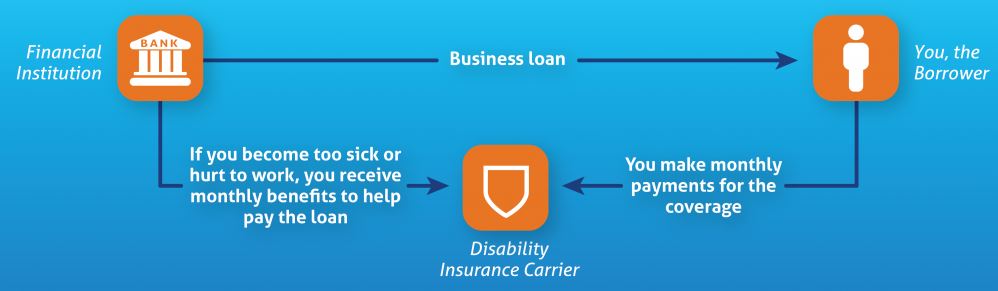

One kind of insurance that shields companies from the financial dangers involved with taking out loans is business loan insurance. Business loan insurance helps pay off outstanding debt in the event of unanticipated occurrences like the disability or death of a key executive, which could make it difficult for the company to repay the loan. This insurance safeguards the owner’s personal assets and guarantees the company’s financial stability.

Factors Influencing the Cost of Business Loan Insurance

The price of business loan insurance is influenced by various factors. Comprehending these variables might aid entrepreneurs in anticipating and efficiently handling their insurance costs.

1. Loan Amount

The cost of business loan insurance is directly impacted by the loan’s principal amount. In general, the insurance premium increases with the loan amount. This is due to the fact that when loan amounts rise, so does the insurer’s risk.

2. Loan Term

The cost of business loan insurance is also influenced by the length of the loan. Higher premiums are typically associated with longer loan periods since the insurer’s risk is dispersed over a longer time frame.

3. Business Type and Industry

The cost of business loan insurance can be greatly impacted by the type of firm and the industry it works in. businesses with higher risk, like manufacturing or construction, could have more expensive premiums than businesses with lesser risk, like retail or professional services.

4. Financial Health of the Business

A company’s creditworthiness and financial stability play a major role in how much insurance costs. Companies with excellent credit histories and sound financial standing might pay less in premiums, while those with less stable finances might have to pay more.

5. Coverage Amount

The cost of business loan insurance is also influenced by the selected level of coverage. Generally speaking, basic insurance with lower limitations will be less expensive than comprehensive policies with larger coverage limits.

6. Age and Health of Key Personnel

The age and health of key individuals will affect the premium if the insurance policy covers their life or health. Lower insurance costs are usually the outcome of younger, healthier individuals.

Benefits of Business Loan Insurance

While knowing how much business loan insurance will cost is crucial, it’s also critical to appreciate the advantages it provides. These advantages can frequently make the cost worthwhile and give business owners peace of mind.

1. cost business loan insurance of Financial Protection

The main advantage of insurance for company loans is that it offers financial security. It guarantees that the company can pay back its debts even in the event of unanticipated events, safeguarding the assets and credit standing of the business.

2. cost business loan insurance of Peace of Mind

Business owners can rest easy knowing that in an emergency, their company’s debts will be paid for thanks to business loan insurance. They can now concentrate on expanding their company without having to worry about money problems all the time thanks to this assurance.

3. Protects Personal Assets

A personal guarantee is required for many business owners in order to obtain a business loan. By covering the outstanding loan amount, business loan insurance safeguards personal assets and helps people avoid financial collapse.

4. Enhances Creditworthiness

The creditworthiness of a corporation can be improved by having business loan insurance. Because they believe their investment is secure, lenders are more inclined to provide firms with insurance coverage with favorable loan conditions and interest rates.

Strategies to Manage the Cost of Business Loan Insurance

Although business loan insurance can be very expensive, there are a number of tactics that companies can use to control and lower these costs.

1.cost business loan insurance of Shop Around

To get the greatest rate, it’s critical to compare various insurance companies and plans. Business owners can find competitive prices and the most value for their money by shopping around and selecting an insurance.

2. Improve Business Financial Health

Insurance premiums may go down if the company’s finances are strengthened. This can be accomplished by continuing to show steady profitability, keeping up strong credit ratings, and managing debt wisely.

3. cost business loan insurance Choose the Appropriate Coverage

Owners of businesses should carefully evaluate what coverage they need and select a policy that fulfills those needs without going overboard. This can guarantee sufficient protection and help save needless expenses.

4. Opt for Group Policies

Group insurance coverage may be a more affordable choice if the company employs several essential personnel. The rates for group plans are frequently less than those for individual policies.

5. Maintain Healthy Lifestyle for Key Personnel

Insurance rates can be lowered by promoting a healthy lifestyle among important staff. Frequent medical examinations, a nutritious diet, and physical activity can all improve an insured person’s health profile and reduce expenditures.

6. Review and Update Policies Regularly

Insurance policies should be reviewed and updated on a regular basis to make sure the coverage is still appropriate and reasonably priced. Policies should be modified as necessary to reflect evolving business needs and conditions.

Conclusion

Any company that depends on loans for capital must comprehend the expense of business loan insurance. Through a thorough comprehension of the variables affecting insurance rates, the advantages of possessing coverage, and efficient approaches to control these charges, entrepreneurs can make well-informed choices that safeguard their capital and guarantee steady finances.

Although purchasing business loan insurance may seem like an extra cost, the security and comfort it provides can’t be overstated. As with any financial choice, you should carefully consider your company’s needs, weigh your options, and select a policy that offers the best value in terms of both coverage and cost. By doing this, you can preserve the financial stability of your company in the face of unforeseen difficulties and protect its future.